Singapore in numbers - Government revenues

The Singapore budget was revealed and debated in Mar 2018; and one of the more controversial aspects of the budget was the discussion on raising the Goods and Services Tax (GST) from the current 7% to 9-10% by 2021 to 2025. The GST hike was proposed to fund growing government expenditures; including social spending in the face of the ageing population, infrastructure investments (e.g. upgrading the MRT network, Changi Airport Terminal 5 etc.). And this started many debates on alternatives to funding future government needs, when it could/should occur etc.

But it also occurred to us at FYT that many of us don’t know as much as we should about the government budget to have an informed discussion about the topic. Clearly this is a complicated topic, but some awareness grounded in data can help.

DID YOU KNOW...

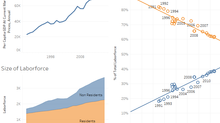

The Singapore Government collected over SG$75B in revenue in FY2017; which constitutes 16.6% of GDP. It should be noted however, that among high income countries, it is not high at all.

The median tax revenue as a percentage of GDP for high income countries is about 22.1%

Iceland having the highest at 38.5% and the United Arab Emirates the lowest being close to Zero.

Singapore’s tax revenue as a percentage of GDP sits just below the 25th percentile

It should be noted that the Singapore Government tax revenue as a percentage of GDP has been growing; from 14.8% in FY2013 to 16.6% in FY2017. Despite this growth, Singapore still collects less from the GDP than most other high-income countries.

Where do government revenues come from?

There are 14 categories of sources of government operating revenue. Barring some one-time spikes, their respective share contribution has remained quite consistent over time.

The top 4 sources of government tax revenues make up over 50% of total government revenue

Corporate taxes bring in the largest portion (20-23%); followed by

Goods and Services Tax (14-16%)

Personal Income Tax (14-15%)

Vehicle quota premiums (5- 8%)

Key observations and considerations

As with any call to raise taxes, it also raises concerns about the impact to the cost of living and disposal income for the citizens in the country. And in Singapore, where it has been consistently ranked as one of the most expensive cities to live in, the concerns are quite valid.

But as the data demonstrates, Singapore’s tax revenue as a percentage of GDP is not high among high income countries (as defined by the Worldbank). But it has been growing over time since FY2013; from 14.8% in FY2013 to 16.6% in FY2017.

The top 4 sources make up over 50% of Government revenues are – Corporate Tax (20-23%), Goods and Services Tax (14-16%), Personal Income Tax (14-15%) and Vehicle quota premiums (5- 8%). Per the budget debates in parliament, the idea of raising the GST from 7% to 9% in the future; this was intended to fund future government spending (i.e. healthcare and social spending in response to rapid ageing, new infrastructure investments). While GST is quite sizeable and clearly could be one efficient option to increase government funding, it is certainly not the only option.

At FYT, we hope that found this useful and we hope that short article could contribute to more informed and objective discussion on the topic. Look out for more form our series of research.